What is 'Dual Living'?

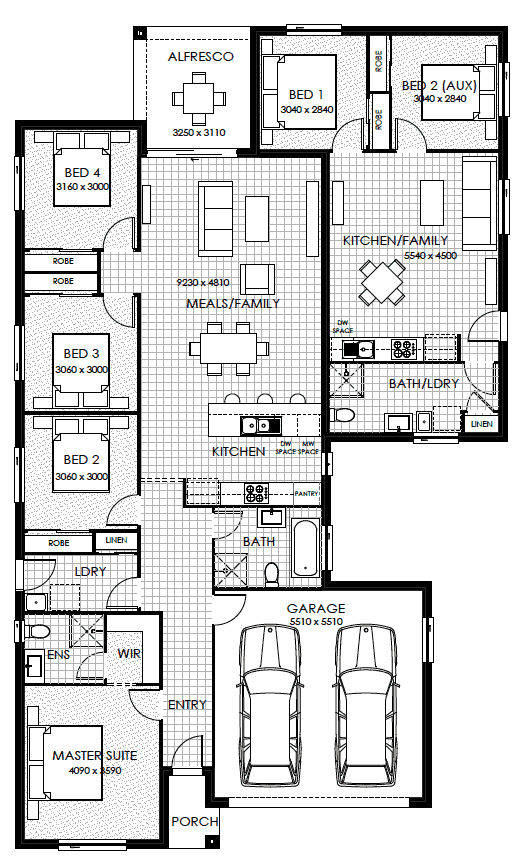

A dual living dwelling is essentially 2 completely separate houses built under the one roof, with a single owner. Each ‘living area’ has its own street entrance, different address, separate front doors, separate kitchen, separate bathroom, separate living areas, separate garden. Power, water, gas, NBN and all other services are separately installed into the separate dwellings: bills go to the respective address.

Looking from the street though, the modern solution looks like a single house and shares the 1 roof. Typically one living area is larger (3 or 4 bedroom) and the other is smaller (2 bedroom)

1.One Property. Two Incomes

Dual living homes allow you to generate two separate rental incomes from one property—boosting your cash flow and return on investment.

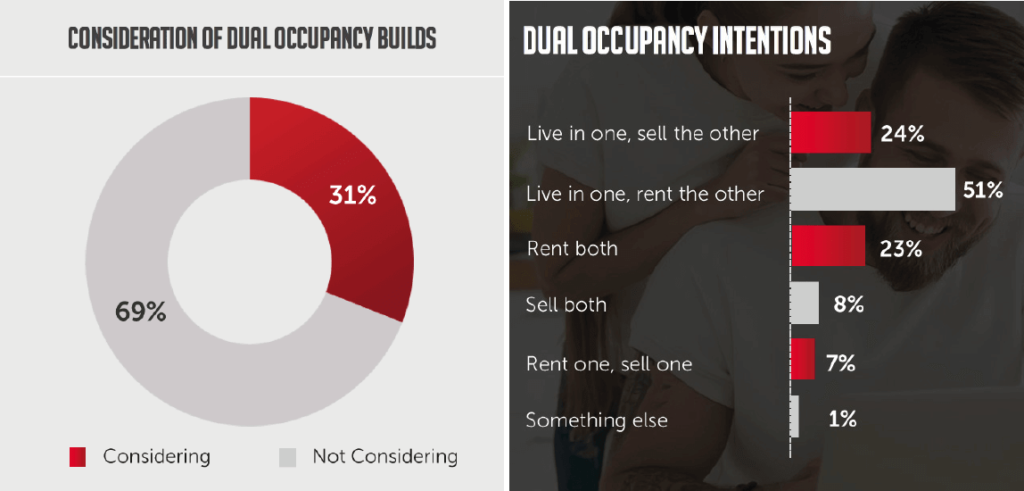

Investors have the flexibility to:

– Rent both dwellings to different tenants.

– Live in one while renting out the other.

– Adapt their strategy over time to suit changing life circumstances.

Marketing Insight: In growth corridors like South-East Queensland, dual living homes are attracting up to 50% more rent than standard single dwellings on a similarly priced block.

2. Stronger ROI on the Last $200K

While a dual living property costs more to build—usually about $200K more than a single home—it generates significantly more income. For example:

– A standalone 4-bedroom home might cost $750K and rent for $650/week.

– A dual living version might cost $940K but rent for $1,130 week combined.

That extra investment delivers a higher ROI and helps maximise land use.

Marketing Insight: With the right design and location, many investors see a 6-7% gross rental yield on dual living homes, compared to 4-5% on standalone homes.

3. Unique Appeal and Long-Term Resale Benefits

Dual living properties can stand out in a competitive housing market. Not every block or builder can accommodate them, which means your investment is more unique. When it comes time to sell, you’ll appeal to:

– Multi-generational families seeking separate but close living.

– Owner-occupiers looking to offset their mortgage with rental income.

– Investors wanting dual income streams.

Marketing Insight: Limited supply in certain areas adds to future resale appeal and may even speed up time to sale.

4. Tax Benefits & Depreciation Advantages

Dual living homes often deliver higher depreciation benefits than traditional homes. As two separate dwellings, investors can depreciate:

– Kitchens, bathrooms, and appliances in both units.

– Additional construction costs and fittings.

– More structural elements.

Even though positively geared dual living homes may attract tax on the rental income, the depreciation benefits can help reduce your overall taxable income.

Tax Depreciation, dual occupancy homes can often provide between $10,000 and $19,000 in first-year deductions—often more than a traditional home.

The Haverton Advantage: Turnkey Delivery & Peace of Mind

With every Haverton dual living home, we include:

Separate metering, Private yards and entries, Appealing design for tenants, Full turnkey finish, Move-in ready from OC, 2-Year Rent Guarantee, Fixed Price Contract, 8-Year Structural Guarantee, 25-Year Roof, Truss & Frame Guarantee, Free Cut, Trim and Blow Before Each Rental Showing

Whether you’re building your portfolio or looking to maximise the value of your land, our dual living solutions offer unmatched potential.

Bonus: Haverton Guarantees That Reduce Your Risk

Investing is always a risk—but ours comes with:

2-Year Rent Guarantee, Fixed Price Contract,8-Year Structural Guarantee, Turnkey finish, fully tenant-ready at OC

Disclaimer: This article is for informational and educational purposes only and should not be taken as financial advice. Please consult a qualified financial advisor for guidance tailored to your specific circumstances.

Need Help?

Choosing the right investment property is a significant decision. We’re here to help you navigate the options and make informed choices.

Explore Our Designs:

– Single Dwelling Homes

– Dual Living Homes

– Duplex Homes

Book a free 15-minute Discovery call with us and learn about how to choose the right investment property design in the right location on the right block to maximise your investment with our 24 -point criteria.

In your call, we’ll discuss:

- Your 2025 Financial Goals: What do you want to achieve this year? What you are capable of doing, save for a down payment? Increase your income?

- Your Current Financial Situation: We’ll analyse your income, expenses, and existing investments.

- Your Investment Preferences: We’ll explore your risk tolerance, preferred property types and desired investment timeframe.

- How Haverton Homes Can Help: We’ll outline our personalized strategies and how we can guide you toward achieving your 2025 financial goals.