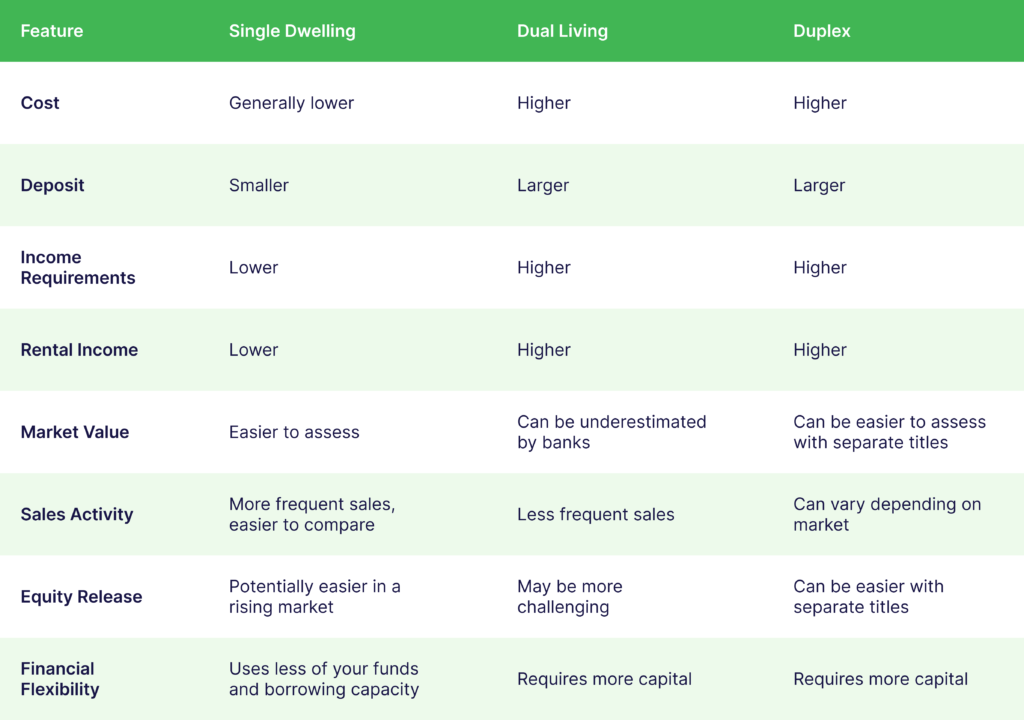

For Australians looking to build wealth through property, one of the first—and most important—decisions is what type of property to invest in.

Should you go with a straightforward single dwelling, explore the dual-income potential of a dual living home, or consider the flexibility of a duplex?

Each option has its advantages, trade-offs, and ideal investor profile. In this guide, we break down the pros and cons, explore what the latest research says about how each performs, and help you consider which might be the right fit for your investment goals.

Understanding the Three Investment Property Types

1. Single Dwelling

A standalone home on a single block of land—often the most familiar and straightforward option.

Best For: First-time investors seeking simplicity and long-term capital growth.

Pros:

Lower entry price

Easier to finance and manage

Strong owner-occupier demand (resale potential)

Ideal for capital growth in blue-chip suburbs

Cons:

Single income stream

Yield may be lower than multi-dwelling options

📊 Market Insight: CoreLogic data shows that standalone houses in high-growth suburbs have historically outperformed units in capital gains over the long term, especially when land scarcity is a factor.

2. Dual Living

A home with two self-contained living areas (e.g., a main residence + granny flat or dual-key layout) on a single title.

Best For: Investors looking for high rental yield, cash flow, and affordability under one roof.

Pros:

• Dual rental income

• Improved cash flow

• Tax depreciation across two dwellings

• Option to live in one, rent out the other

Cons:

• Slightly higher build cost

• May face zoning and approval restrictions depending on the local council

• Can require more active property management

📊 Market Insight: Suburbs with a growing demand for multi-generational or shared-living households (e.g., outer metro growth corridors) are seeing increased investor interest in dual living builds. SQM Research shows rental yields can be 1.5–2% higher than traditional single homes in these areas.

3. Duplex

Two fully independent dwellings, often with individual entrances and the option for separate titles.

Best For: More experienced investors looking for capital growth, development upside, or future flexibility.

Pros:

• Two separate rental incomes

• Sell one dwelling, hold the other

• Often higher capital growth potential with land value

• Ideal for subdivision or future resale options

Cons:

• Higher upfront costs (build and approvals)

• More complex to finance and construct

• Requires larger block and DA approvals

📊 Market Insight: Duplex projects can deliver significant equity uplift. In areas like South East Queensland and Western Sydney, duplex builds have created six-figure value increases within 12–18 months due to subdivision potential and strong buyer demand for low-maintenance homes.

Key Factors to Consider

Key Questions to Ask Before You Choose

- What is your investment timeframe—5, 10, 15 years?

- Are you prioritising cash flow or capital growth?

- How hands-on do you want to be with property management?

- What are the local market trends in your target suburb?

- Do you want subdivision potential down the track?

Explore our designs:

Disclaimer: This article is for informational and educational purposes only and should not be taken as financial advice. Please consult a qualified financial advisor for guidance tailored to your specific circumstances.

Ready to Explore the Right Strategy for You?

At Haverton Homes, we offer all three types of properties and guide investors every step of the way. Whether you’re after a simple single dwelling in a growth suburb, a high-yielding dual living design, or a custom duplex project—our team can help you assess your options and build the right property for your goals.

👉 Book a free 15-minute discovery call to chat with one of our friendly team specialists.

We’ll help you understand the numbers, the market, and the opportunity—so you can invest with confidence.

Need Help?

Choosing the right investment property is a significant decision. We’re here to help you navigate the options and make informed choices.

Hear what our ciustomers are saying

Dom and Candy

”We were initially apprehensive first-time investors, but the Haverton Homes team took the time to understand our needs and presented us with a variety of options. Their expertise and guidance were invaluable, and they made the entire process seamless and stress-free. We’re extremely happy with our new property and the after-sales service provided.” Rating: 10/10

Arvind & Prajwala

Geoff and his team at Haverton Homes were absolutely fantastic. They made the entire building process stress-free and enjoyable starting with an incredible discovery call. We’re thrilled with our beautiful new dual-living house and the positive cash flow it’s generating.” Rating: 10/10

Jody

“I would absolutely recommend Jeff and the company for project management. They took the stress away from the process, as I didn’t know much about building. The discovery call and educational process was incredible. Everything Geoff promised was delivered. I would absolutely recommend Goeff and the Haverton team to any of my friends, which I’ve already done.” Rating :10/10