Dual Living – One Property, Two Incomes

In today’s challenging market, where interest rates are high and affordability is tight, many would-be investors feel like property is out of reach. But the truth is—there is still a way to afford investing. Dual living homes are flipping that script, offering savvy investors a pathway to property ownership that comes with two rental incomes from one property, all for a lower entry price than you might expect and near-positive cash flow from day one.

💡 Key Insight:

Dual living homes from $940K are generating up to $1,130 per week in rent in high-demand regional growth areas—yields that traditional homes just can’t touch. Plus, these properties offer $18K per year in depreciation, providing even more value to investors.

Dual living homes allow you to capitalize on strong rental returns and depreciation advantages, all while keeping upfront costs lower than a traditional duplex or single dwelling investment.

But let’s clear something up: there’s a lot of noise in the market about dual occupancy, duplexes and granny flats—and it’s easy to get confused.

Dual living is not the same as a duplex or dual occupancy.

What sets dual living apart is the fully self-contained second living space within a single title—designed to maximise returns without the hassle and expense of subdividing. A duplex or dual occupancy often involves multiple titles or subdivision, requiring additional approvals and costs. Dual living, on the other hand, keeps it simple, with one title and the ability to generate two rental incomes without the extra complexities.

Here’s how it compares to other property types:

Single Dwellings: These only provide one rental income and usually come with higher purchase prices. There’s no flexibility to generate income from multiple tenants or households.

Duplexes: Two separate dwellings typically mean two titles (if subdivided), additional council approvals, separate utilities and higher upfront costs. While they offer dual income potential, they come with more red tape and complexity.

Dual Living: Two self-contained rental spaces under one roof and one title—making it a simpler, more affordable way to grow your property portfolio. Dual living homes are often purpose-built to appeal to tenants and maximise yield, delivering strong rental returns with fewer hurdles from day one.

Why Dual Living Works: The Strategic Investor’s Perspective

So, why should you pay attention to dual living in 2025?

Because it just makes sense—especially in a market where every dollar counts.

Here’s why dual living stacks up, even in a cooling market:

- Land is getting more expensive—so make the most of it. Dual living lets you maximise your return from a single block.

- Rental demand is hot, particularly in growth suburbs facing housing shortages.

- Tax benefits and depreciation can significantly improve your after-tax cash flow.

- Lower price point than a duplex, but similar income potential—making it accessible to more investors.

- Greater layout flexibility than a duplex or single dwelling—live in one, rent the other, Airbnb one side down the track, or accommodate extended family.

📈 The numbers don’t lie:

According to CoreLogic’s ‘Best of the Best 2024‘ Report Regional NSW is currently delivering some of the highest rental yields in the state—ranging from 6.5% to 8.9%, nearly double what you’ll find in Greater Sydney’s top suburbs.

From Lismore to Muswellbrook, smart investors are identifying locations where high yields, rising rents and long-term growth potential intersect. Whether your priority is cash flow, capital growth or a mix of both, dual living homes give you the leverage to make it happen—without overextending yourself.

Real Numbers: What $940K Buys You

- Rent 1 (Granny Flat): $480/week

- Rent 2 (Main House): $650/week

- Total Rental Income: $1,130/week

- Gross Yield: 6.25%+

Factor in tax savings and depreciation (covered in your Free Property Investment Analysis Report) and this becomes a smart choice for those chasing high cash flow or looking to balance their portfolio.

Haverton Guarantees That Reduce Your Risk

✅ 2-Year Rent Guarantee

✅ Fixed Price Contract

✅ 8-Year Structural Guarantee

✅ Turnkey finish, fully tenant-ready at OC

This means less stress, less uncertainty and faster returns.

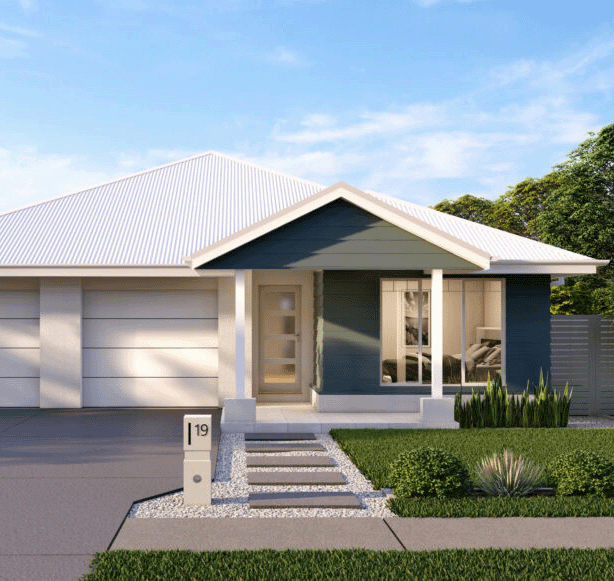

Popular Dual Living Designs

1. Lachlan

Versatile living for investors and families.

Features a 4-bedroom home with a granny flat, separate garage, wide porch, spacious alfresco, and optional walk-in pantry. Designed to fit on lots as narrow as 15 meters

2. Oxley

Flexibility and function.

Main dwelling with 4 beds, 2 baths, large alfresco + separate granny flat with L-shaped kitchen and its own garage and alfresco. Choose this design if the lot is over 18.5 meters wide.

3. Francis

Perfect for growing families. Granny flat has its own yard and kitchen, extra storage options in the main home. Choose this design if the lot frontage is a minimum of 16 meters.

The Haverton Difference

With every Haverton dual living home, we include:

✅ Separate metering

✅ Private yards and entries

✅ Appealing design for tenants

✅ Full turnkey finish

✅ Move-in ready from OC

Plus:

✅ 2-Year Rent Guarantee

✅ Fixed Price Contract

✅ 8-Year Structural Guarantee

✅ 25-Year Roof, Truss & Frame Guarantee

✅ Free Cut, Trim and Blow Before Each Rental Showing

Included in every turnkey package:

- Receive Tenants’ Bond Payment Before OC

- Tenants Able to Move in Immediately After OC

- Nothing More for You to Do

- Driveway, Landscaping, Fences, Garden, Clothes Lines, Numbered Letterboxes

- Separate Entrances, Separate Parking, Backyards

- Wall Hung Vanities, Soft Close Doors and Drawers, Stone Bench Tops

- Includes Build Permit, Approvals, Council Contributions

- Strong Bank Valuations, High Capital Growth

Top Dual Living FAQs Answered

Q: What’s the difference between dual living and a duplex?

A: A duplex involves developing two separate dwellings on a single lot which is subdividable, however a Dual living is including a secondary dwelling which is a small, self-contained unit annexed to the main dwelling, offering two tenancies under one title—easier and more affordable.

Q: Can I claim depreciation on both dwellings?

A: Yes. Both sides are eligible, boosting your tax return in the early years.

Q: Will both homes be separately metered?

A: In most areas, yes—separate water, gas and electricity metering is included.

Q: What kind of tenants rent dual living homes?

A: dual living homes are are typically suited for smaller households or individuals, such as retirees, students, or young families who need affordable housing options in close proximity to family support.

Q: Are dual living homes harder to manage?

A: Not with the right property manager—and Haverton offers a 2-year rent guarantee to make things even easier.

Final Word: One Property. Two Incomes. Real Results.

If you’re looking to invest without overextending yourself, dual living offers a smart path with genuine cash flow and long-term growth potential. In 2025, it remains one of the most effective strategies to get started in property investment—maximising rental income under one roof with minimal financial strain.

👉 Enquire now to find out where and how.